Building the European Capital Markets Union

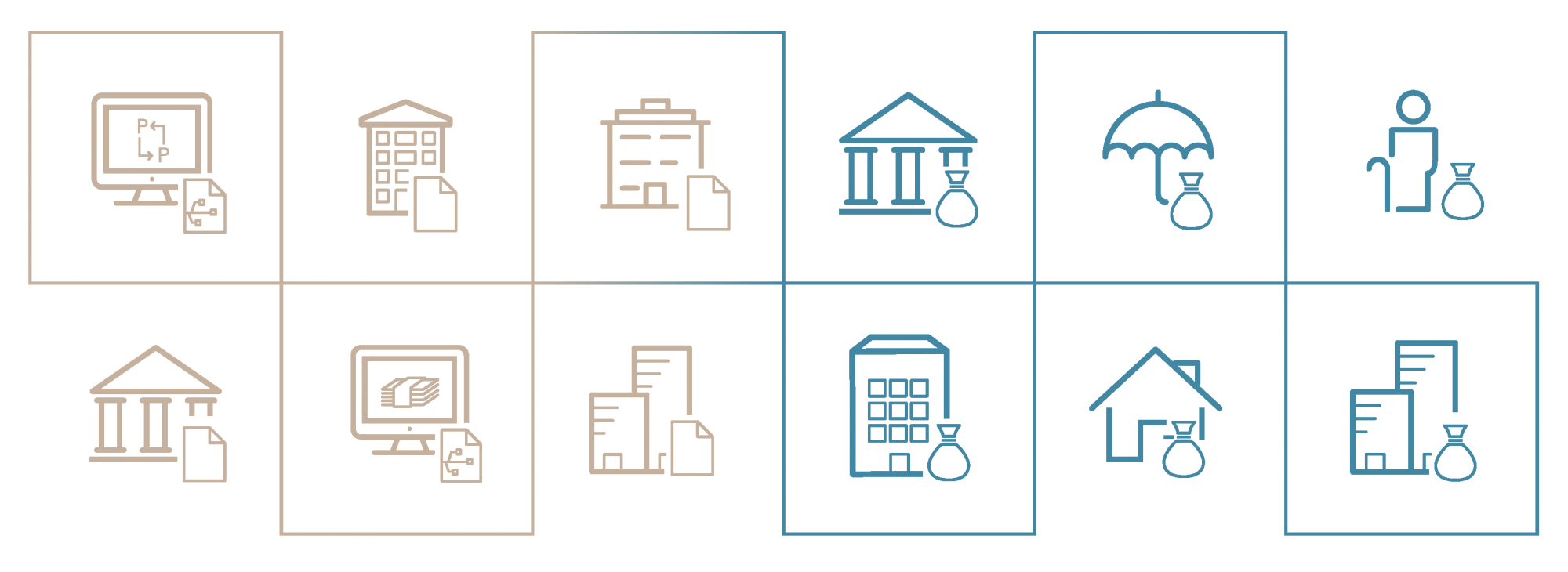

Rewiring the investment & lending ecosystem

Who we are

Through our products and solutions we’re streamlining Europe’s lending and investment ecosystem and facilitating the flow of capital across Europe. By providing both loan originators and investors with a single onboarding hub, centralised due diligence and standardised data, our platform and services empower lenders to lend more and investors to more efficiently distribute their capital.

“Well-functioning debt capital markets are crucial for stability in Europe, yet investment banking in debt markets has mostly remained undisrupted through digitisation until now. The arteries of our financial system are clogged, leading to severe economic restrictions for companies and individuals in Europe. CrossLend is rewiring the lending and investment ecosystem in the spirit of the European capital markets union.”

Oliver Schimek, CEO & Founder

Our track record